24 January 2025

Financial automation is extremely important-need to construct your financing company now. Those who you should never adopt automation technology chance shedding about the crowd.

The borrowed funds business has expanded exponentially for the past a decade. Processes which were paper-mainly based and you can completed in people are now able to performed entirely online, of one place. The mortgage companies that welcomed automation tech was able to improve the processes, save money, increase the output of its class and you can rapidly scale having demand.

Electronic Onboarding

The first step in the mortgage origination procedure starts with event study about buyers. Usually, this has been done by filling in forms, each other digital or papers data files, which is time-drinking, labor-intensive and one of the most important demands out of launching the loan procedure.

Not only does yourself completing variations possess a relatively lower achievement price, although with greater regularity this post is entered and you can reentered to your this new lender’s possibilities, you will find an elevated danger of investigation being recorded inaccurately.

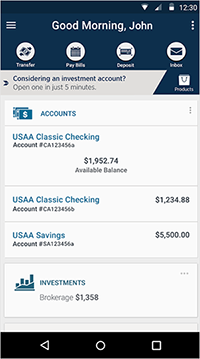

Consumer-up against portals, including the Mortgage POS, normally support electronic onboarding by allowing people doing the home loan loan from inside you to program, into the one device anywhere as well as anytime. This information feeds straight into the brand new lender’s LOS in which lender-discussed rules is also begin the next phase of your loan procedure.

Document Government

Lenders deal with large volumes of data coming from additional offer in different formats. For many years, this usually https://clickcashadvance.com/installment-loans-vt/ required guide check to evaluate for problems or completeness. Automation has significantly lessen human input which had been necessary to get and you will comment such records.

Automation technical can also be speed up indexing, extraction and you will submitting, releasing loan providers in the boring process of yourself running data files. This helps lenders in certain indicates:

- Better accessibility go out: Your staff normally focus on high-well worth products instead of manually control documents.

- Less time to close: A reduction in document running big date can simply force that loan from pipe and in the end produce a faster closing.

- Fewer mistakes: AI document processing is perfect, that have error rates less than 5% to possess arranged data files. This reduces the odds of people error and you can boosts the underwriting procedure.

- Capability to level: Just like the automation has had more instances on era away from functions, their financial business has the capacity to handle large volumes and you can level having demand.

Underwriting

Using automated underwriting expertise (AUS), loan providers can also be instantly be certain that work, assets additionally the creditworthiness of the debtor. Electronic mortgage networks have fun with conditional approvals one to simply take minutes in the place of weeks to complete.

Certain automatic confirmation enjoys makes it possible for borrowers to upload bank comments otherwise securely approve access to its monetary information off their financial or other loan providers. Immediately following lenders fully grasp this study, VOI and you will VOE providers is also instantly make sure income and you can work.

The newest automated system compares new customer’s credit rating, debt and other points to the needs and you can direction of one’s financing. Because the computers-produced financing choice was obtained, lenders is also double-browse the impact and supply the customer having a decision.

Join BeSmartee is why Digital Financial Web log for:

- Home loan Industry Knowledge

- Safety & Compliance Position

- Q&A’s Featuring Home loan & Technology Benefits

- Pull study more efficiently to ensure analysis, process files and you may flag inconsistencies

- Examine customer guidance facing a career database

Prices Selection

An item prices motor, otherwise PPE, try application you to definitely mortgage lenders control so you’re able to estimate genuine-time financial cost choices. Using a pricing motor, lenders is also instantly generate various other mortgage cost conditions with varying rate alternatives.

It allows mortgage professionals to reduce the amount of time spent to your mortgage processes. It permits lenders evaluate prices all over individuals lenders. PPEs may lock in prices, providing consumers more hours and also make a final decision.

Disclosures and you will Conformity

The home Financial Revelation Operate (HMDA) needs financial institutions to keep up, statement and you may publicly disclose details about the financing strategies, that they need to yield to regulatory regulators. This new HMDA brings greater openness and assists to guard consumers out-of predatory financing methods.

Disclosures offer borrowers details about their mortgages, instance costs they will bear, otherwise factual statements about the escrow membership. First disclosures imply that individuals want to go-ahead and you can authorize loan providers to about concentrating on the loan document.

Automation technology brings loan providers a better and you may clear answer to create the new revelation processes and be certified having federal legislation. Lenders normally track disclosure requests, score big date-seal of approval towards most of the telecommunications and you can signatures and determine brand new revelation condition of all fund planned.

Roundup

The mortgage world has come a long method, but many businesses nevertheless greatly believe in instructions procedure that will easily be taken over because of the automation. Automation lets loan providers are better, beneficial and you may tuned in to their clients. Guidelines process just can’t contend with the major competition when you look at the home loan today.

Like to see what automation does for your mortgage company? Get in touch with BeSmartee more resources for the Mortgage POS and exactly how it does enhance your mortgage origination techniques.